Nigeria’s foreign reserves has added $3.15 billion Dollars in 33 days, rising from $33.42 billion recorded in April, 2020 to $36.15 at the beginning of June, 2020 which may not be unconnected with the jump in crude oil prices that have surged closer to $40 per barrel.

Brent crude traded for $39.38 a barrel at 3:40 am Nigerian time, failing to stay over the $40 resistance price level, while the Nigerian Bonny light price against earlier predictions, surged closer to $40, as it closed at $37.57 per barrel mark, up by 5.57% on Wednesday.

This is coming against the backdrop of a decline in crude oil inventory by 483,000 barrels for the week ending May 29, as estimated by the American Petroleum Institute (API) on Tuesday, and signs that OPEC+ producers are close to agreeing on a short extension of their historic deal to cut output.

The steady rise of the foreign reserves, has also given the CBN Governor, Godwin Emefiele, more ammunition to defend the naira.

The naira has been stable in the short term, even though data obtained from Everdon Bureau de Change showed that the currency had failed to break the resistance price level of N450 to $1 in the last 6 days in Nigeria’s parallel market.

Weeks ago, the naira traded as high as N475 to $1. However, on Thursday morning it was sold at N446 to $, proving that Nigeria’s monetary captain is bent on stabilizing the currency for the long haul.

Recall that the CBN Governor had warned currency speculators and hoarders to stop manipulating Nigeria’s exchange rates. He also recommended that Nigerians should stop patronizing black market currency operators. According to him, the rates they are buying the dollar from the black market are unrealistic.

In addition, Nigeria’s central bank recently re-started the weekly dollar sales of $100 million for small businesses and individuals who are in genuine need of foreign exchange.

According to a financial analyst, Philip Anegbe, Team Lead at CardinalStone Research, the pressure on the naira is gradually easing off.

“I believe some of the recent pressures on FX is driven by speculators’ panic responses to weakness in dollar earnings, the decline in FX inflow through the I and E window, and suspension of dollar sales to BDCs (Bureau De Change operators),” he added.

You may be interested

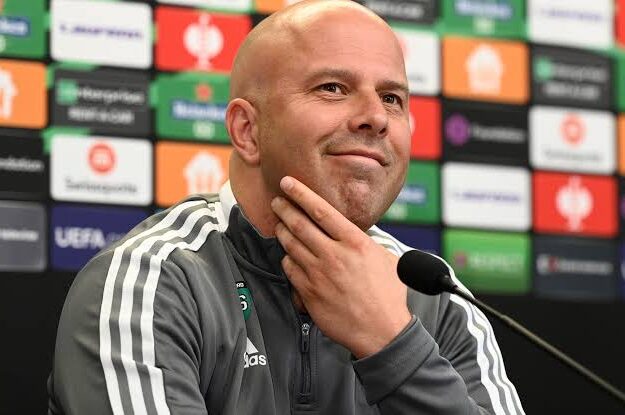

Super Eagles Must Qualify For 2026 World Cup – NFF Tasks Finidi

Webby - April 30, 2024Newly appointed Super Eagles head coach Finidi George has been tasked with the responsibility of ensuring the team’s qualify for…

NFF Settled For Finidi Due To Financial Constraint –Ikpeba

Webby - April 29, 2024Former Nigerian international, Victor Ikpeba has finally disclosed why the Nigeria Football Federation (NFF) settled for Finidi George as the…

Serie A: Lookman On Target As Atalanta Overcome Empoli

Webby - April 28, 2024Super Eagles star, Ademola Lookman was on target as Atalanta defeated Empoli 2-0 in Sunday’s Serie A game.The Nigerian international…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)