Trading on the Nigerian Stock Exchange (NSE) have continued to react negatively to the outcome of the presidential election with the market capitalisation losing N196 billion to close below N12 trillion mark in February. Market capitalisation for last trading day in February shed N196 billion or 1.63 per cent to close at N11.828 trillion against N12.024 trillion on Wednesday, despite dividend of N16 declared by Dangote Cement.

Specifically, the market capitalisation shed N196 billion or 1.63 per cent to close at N11.828 trillion compared with N12.024 trillion achieved on Wednesday. In the same vein, the All-Share Index lost 525.54 points or 1.63 per cent to close at 31,728.70 when compared with 32,244.24 recorded before the election results announcement.

A market analyst, Ambrose Omorodion, attributed the development to investors disappointment over the outcome of the elections. Omorodion said that smart investors that took a position earlier in the market ahead of the presidential election and earnings seasons were disappointed.

He said that the outcome of the election failed to meet their expectations with many of them resorting to profit taking and movement of funds to the fixed income market with high interest and lower risk. According to him, investors are dumping their shares in spite of impressive earnings reports and high yields. He said that apart from the outcome of the elections, everything was against the stock market ranging from delayed budget, expiration of the tenure of CBN governor by June.

“The only factor for the stock market now is this earnings season, because nothing will happen between now and May 29,” Omordion said. He said that 2019 budget implementation would likely commence in July and the Central Bank of Nigeria governor tenure likely to expire in June contributed to the current trend. Omorodion said that the trend might likely continue unless there was a change in economic policies and reforms by the president re-elect.

He, however, called on investors to target pension funds stocks that were consistent in dividend payment in the last four years. Some blue chips dominated the losers’ table and this was led by Nestle having lost N30 to close at N1,470 per share. Nigerian Breweries trailed with a loss of N3.70 to close at N79.50, while Guaranty Trust Bank declined by N2.60 to close at N35.35 per share. Stanbic IBTC depreciated by N2.05 to close at N46.25, while Dangote Flour Nigeria was down by N1.05 to close at N10.90 per share.

On the other hand, Dangote Cement having declared N16 dividend for 2018 financial year led the gainers’ table with N3.80 to close at N195.30 per share. GlaxoSmithKline followed with a gain of 35k to close at N12, while UAC Property gained 9k to close at N1.91 per share.

You may be interested

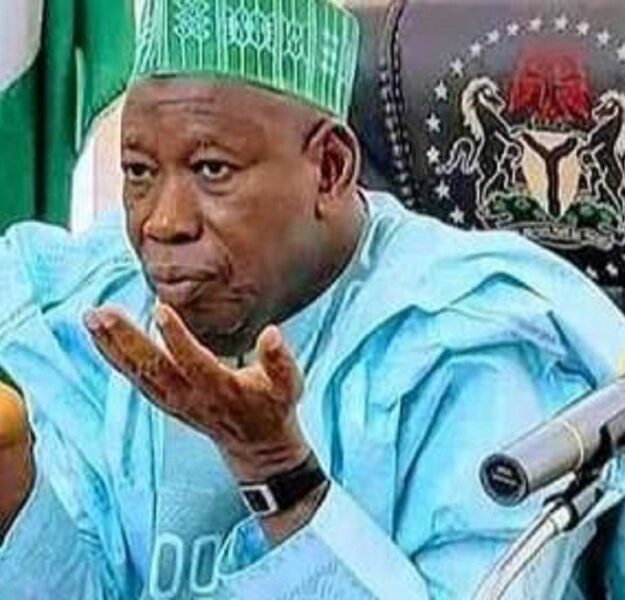

BREAKING: Kano APC voids Ganduje’s suspension, sanctions ward leaders

Webby - April 15, 2024The State Working Committee of the Kano chapter of the All Progressive Congress (APC) has sanctions some ward party leaders…

Yahaya mourns as Maidalan Gombe family loses six members in road accident

Webby - April 15, 2024Gombe State Governor, Muhammadu Inuwa Yahaya has mourned as the Maidalan Gombe family lost six members in a road accident.The six…

How Nigerian Army arrested Yoruba Nation agitators dressed in foreign military camouflage, armed with dangerous weapons

Webby - April 15, 2024The Nigerian Army had revealed that arrest of agitators of the Yoruba Nation who were dressed in foreign military camouflage…

![American Pastor, David Wilson Seen Eating The Box Of Woman Who Isn’t His Wife [Video]](https://onlinenigeria.com/wp-content/uploads/2019/10/american-pastor-david-wilson-seen-eating-the-box-of-woman-who-isnt-his-wife-video-150x150.jpg)